non filing of tax return meaning

The meaning of the term specified person. Tax Return to request copies of tax returns.

Delinquent Taxes Infographic How To Pay Off Or File Late Taxes Tax Debt Tax Help Filing Taxes

We have no record of a filed Form 1040 1040A or 1040EZ using the above Social Security Number.

. Penalty on late filing. If you choose the option ITR has been. Individual Tax Return.

Since failure to pay income tax which is tax evasion involves moral turpitude then non-filing of ITR also involves moral turpitude. Consequently the defenders of Marcos Jr who readily admit that the crime. Generally you will be required to submit your Income Tax Return if in the preceding calendar year.

There are some myths associated with filing. You have self-employed income with a net profit more than 6000. Login through your registered id at wwwtdscpcgovin.

Interest compounded daily is also charged on any unpaid tax from the due date of the return until the date of payment. Prescribed penalty plus imprisonment of at least 3 months extendable up to 2 years. The non-filing and the non-payment of tax returns are two of the most common violations committed by the taxpaying public.

Penalty on late payment. Mail or Fax the Completed IRS Form 4506-T to the address or FAX number provided on page 2 of form 4506-T. If the 4506-T information is successfully validated tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days.

Available from the IRS by calling 1-800-908-9946. 500000 and filing the income tax return after 31st december but before 31st march of the assessment year then the amount of fee shall be rs10000. The point is that failing to file a tax return should never be an option.

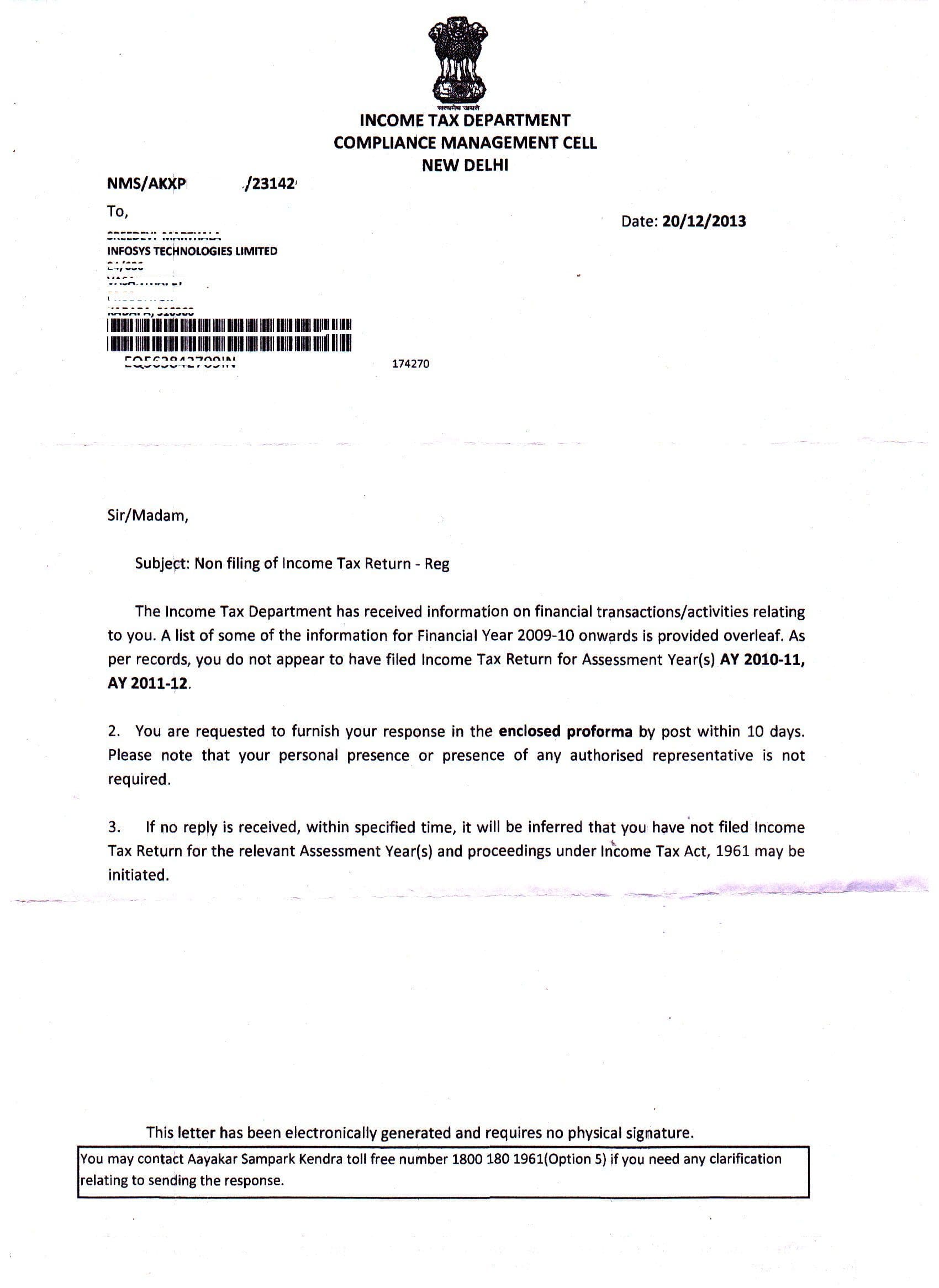

Individuals required to file tax. As I did not file my Tax Return I had received non-filing of Income Tax Return Notice from the IT department. Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years.

Rate of TDS deduction. A student or parent who has never filed a federal tax return will need to complete an IRS Form 4506-T available at wwwirsgov. Select Option 1 for English.

The Tax Code considers failure to file ITR and failure to pay income tax as crimes of the same nature and gravity because these two crimes are found in the same Section 255 of the Tax Code and they carry exactly the same penalties. This is a compliance notice asking me to furnish informationreasons for not filing my ITR. Select Option 2 to request a Tax TranscriptIRS Verification of Non-filing.

Late filing or non-filing of Individual Income Tax Returns Form B1BPM The large majority of taxpayers e-file their tax returns by the due date of 18 Apr each year or by 15 Apr if they paper file. 5 of the tax due and a late payment interest of 1 per month on the unpaid tax until the tax is paid in full. If failure to pay income tax is a crime involving moral turpitude then failure to file ITR is also a crime.

Its most general use describes non. Flores the Supreme Court agreed with its investigating officer that evasion of income tax is a crime involving moral turpitude. It Says that Your Income Chargeable to Tax for the Assessment Year 2010-11 has escaped assessment within the meaning of Section 147.

Both single and married taxpayers with and without dependents file. The use of the term noncompliance is used differently by different authors. This may include tax avoidance which is tax reduction by legal means and tax evasion which is the criminal non-payment of tax liabilities.

Follow prompts to enter the numbers in their street address that was listed on the latest tax return filed. This return shall be filed by every resident citizen deriving compensation income from all sources or resident alien and non-resident citizen with respect to compensation income from within the Philippines except the following. It says We received a request dated March 30 2020 for verification of non-filing of returns for the above tax period or periods.

The Income Tax Act 1961 and the Income Tax Rules 1962 obligates citizens to file returns with. Go to StatementPayments TAB after login then declaration for Non filing of TDS. Non Filing Of Tax Return Meaning.

Section 206AB mandates the person to deduct TDS in case of non-filing of an income tax return by the specified person. You can quickly request transcripts by using our automated self-help service tools. Section 206AB of the Income Tax Act is recently introduced vide the Finance Act 2021.

ITR has been filed. If requested on your FAST page please obtain a Verification of Non-Filing letter from the IRS and submit a copy to the Financial Aid Office. If you did not print and mail the federal tax return then the return was never filed.

You can choose one of the below response options. Tax filers must follow prompts to enter their social security number. There you go with a comprehensive guide on the various penalties for delayed tax return filing.

An individual whose taxable income does not exceed P 25000000. Individual Income Tax Returns should be filed on or before 30th June of the following year. The present article briefly explains the provisions of section 206AB.

For possible tax evasion exceeding Rs25 lakhs. Mail or fax Form 4506-T to the address below for the state you lived in. In the 1979 case of Zari v.

On this page you will be able to check the details of the assessment year for which the return is not filed and of which the Income Tax Department has received the information from the third party. The total penalty for failure to file and pay can eventually add up to 475 225 late filing 25 late payment of the tax owed. Please visit us at IRSgov d click on Get a Tax Transcript.

Your total income is more than 22000. You or in the case of a partnership the precedent partner will face enforcement actions for any late or non-filing of your Individual Income. Submit the form to the IRS as indicated in the form instructions.

Income tax return is the form in which assessee files information about hisher income and tax thereon to Income Tax DepartmentVarious forms are ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7When you file a belated return you are not allowed to carry forward certain losses. You can consider this letter a verification of non-filing The Tax Periord or Periods is December 2018. The Madhya Pradesh High Court has observed that mere non-filing of Income Tax Return would not automatically dislodge the source of income of the complainant in a cheque bounce case under Section.

Whichever is higher between 5 of the tax due or Kshs. Tax noncompliance informally tax avoision is a range of activities that are unfavorable to a governments tax system. ITR has not been filed.

Submit the letter to the financial aid office. Under Tools o call 1-800-908-9946. Whether the non-compliance is a mere omission or a deliberate attempt to.

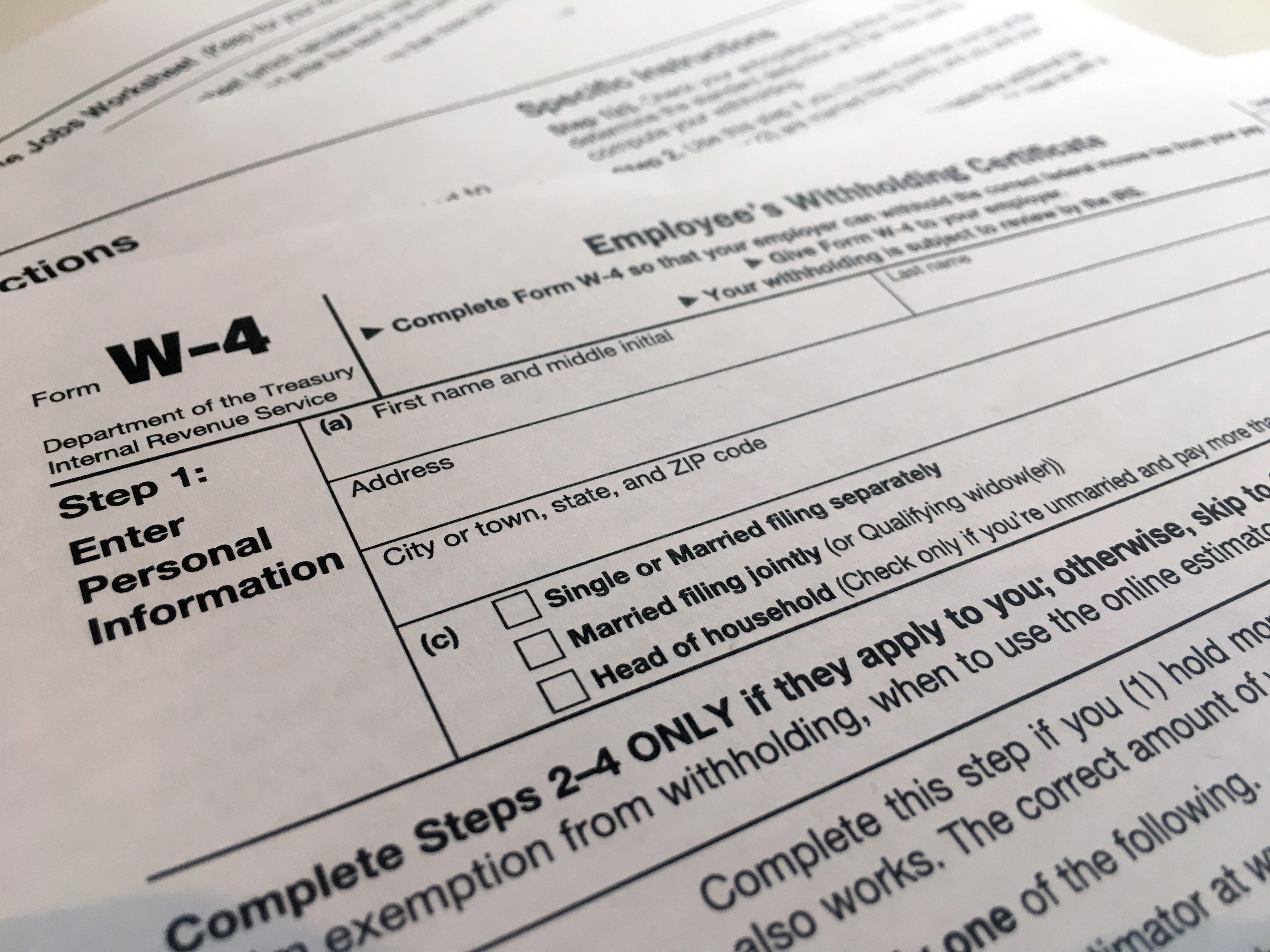

The type of tax return filed by an individual. A tax return is the tax form or forms used to report income and file income taxes with tax authorities such as the Internal. You are a non-resident who derived income from Singapore.

Procedure for filing of declaration for non-filing of TDS statement is given below.

How To Fill Out A Fafsa Without A Tax Return H R Block

Section 206cca Higher Rate Of Tcs For Non Filers Of Income Tax Return Income Tax Return Income Tax Income

Benefits Of Income Tax Return Filing Before Due Date Itr Filing Rules Income Tax Return Income Tax Return Filing Income Tax

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Llc Vs S Corp Which Is Right For Your Business Filing Taxes Income Tax Return Tax Debt

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Structure And Ways To File Itr 2 Form And Given Detail About Eligibility To File It Https Www Mastersindia Co B Income Tax Return Indirect Tax Income Tax

Do You Need Help Filing Your Income Tax Returns Get Help From An Expert T Income Tax Income Tax Return Accounting Services

Most Important Benefits Of Filing Nil Income Tax Returns

Get The Best Taxation Services From A Reputed Tax Consulting Firm Our Tax Advisors Provide A Host Of Taxation Service Video Filing Taxes Tax Consulting Tax Services

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only D Online Taxes Income Tax Filing Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Do You Need To File A Tax Return In 2022 Forbes Advisor

July 4th Wishes Filing Taxes Happy Independence Day Income Tax

Form 1040 U S Individual Tax Return Definition Tax Tax Time Start Up

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Do I File A Tax Return If I Don T Earn An Income E File Com

How To Respond To Non Filing Of Income Tax Return Notice

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com