does cash app report to irs for personal use

SQ Cash App and Paypal Holdings Incs NASDAQ. Cash App is a peer-to-peer payment app that allows users to send and receive money.

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

Sale of a personal residence.

. What Is The Cash App And How Does It Work. This lesson will help you identify the assets holding period adjusted basis net short-term and long-term capital gains or losses the taxable gain or deductible loss the tax liability and the amount of any capital loss carryover. Cash App Taxes is free but Cash Apps other features may not be.

Many people use Venmo strictly for personal transactions the company reports that the average payment amount is 60. This does not affect the due dates for estimated. PYPL Venmo to report business.

Personal Finances 6-minute read August 25 2021. Registration is a piece of cake and you can use your contacts or email addresses to find your friends. Postponed filing date does not affect estimated tax payment due dates.

Cash App offers more services than tax preparation alone and if you decide to use them you may have to pay a fee. The IRS postponed the date to file 2020 Forms 1040 and 1040-SR and to pay any related tax due until May 17 2021. If the taxpayers have sold any other assets refer them to a professional tax preparer.

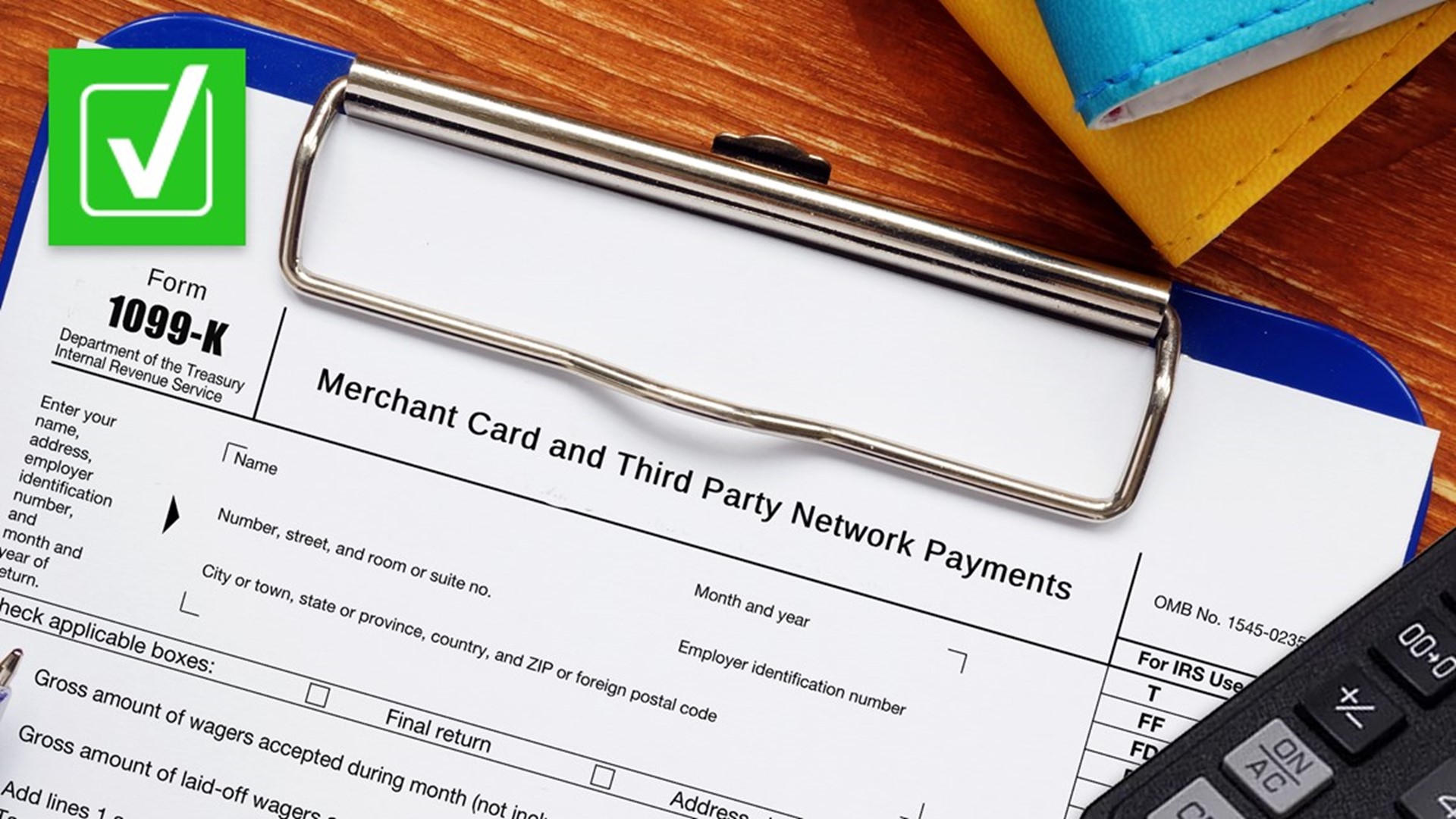

Learn how Cash App works and about all of its additional features. The app is simply a digital wallet connecting to your payment methods. Starting this year the IRS is requiring mobile payment apps such as Zelle Block Incs NYSE.

The intake and interview sheet asks. Use your 2020 tax return as a guide in figuring your 2021 estimated tax but be sure to consider the following. It allows you to easily split rent with your.

Pin By Dominique Rogers On Organize Life Tax Deductions Property Tax Rental Property

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Fact Or Fiction The Irs Is Tracking Money Earned On Paypal And Cash App Cnet

New Rule To Require Irs Tax On Cash App Business Transactions Wciv

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Organization Solutions

Tax Reporting With Cash For Business

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 San Francisco

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Irs Forms Fillable Forms 1099 Tax Form

Pin By Cheryl Neely On Financial In 2022 Personal Finance Clark Howard Paying Taxes

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Does The Irs Want To Tax Your Venmo Not Exactly

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules